Trust Foundations: Trustworthy Solutions for Your Building

Safeguarding Your Assets: Depend On Foundation Competence at Your Fingertips

In today's intricate monetary landscape, making certain the protection and growth of your properties is critical. Trust fund foundations serve as a foundation for securing your riches and legacy, offering an organized strategy to asset security.

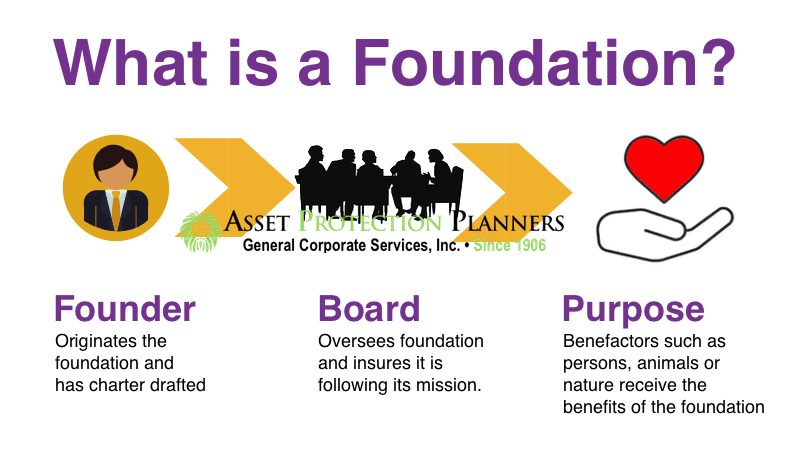

Significance of Trust Fund Structures

Depend on foundations play a vital duty in establishing credibility and cultivating strong relationships in different expert setups. Trust fund foundations serve as the foundation for moral decision-making and clear communication within organizations.

Advantages of Professional Guidance

Building on the foundation of trust in expert connections, looking for expert guidance provides very useful advantages for people and companies alike. Expert advice offers a wealth of knowledge and experience that can aid browse complicated financial, legal, or tactical challenges effortlessly. By leveraging the competence of experts in different fields, individuals and organizations can make informed choices that line up with their objectives and ambitions.

One substantial benefit of expert support is the capability to accessibility specialized knowledge that may not be easily available otherwise. Professionals can provide understandings and point of views that can result in innovative services and possibilities for growth. Furthermore, dealing with professionals can assist mitigate dangers and uncertainties by providing a clear roadmap for success.

In addition, expert support can save time and sources by streamlining procedures and preventing expensive blunders. trust foundations. Professionals can offer personalized advice tailored to specific requirements, guaranteeing that every decision is educated and strategic. Overall, the benefits of expert assistance are multifaceted, making it a beneficial property in protecting and taking full advantage of properties for the long-term

Ensuring Financial Safety And Security

In the world of economic preparation, safeguarding a secure and flourishing future joints on tactical decision-making and prudent financial investment options. Guaranteeing monetary safety involves a complex technique that incorporates numerous facets of wide range monitoring. One crucial component is developing a varied investment portfolio tailored to specific danger tolerance and monetary objectives. By spreading out investments throughout various asset courses, such as stocks, bonds, property, and products, the threat of substantial economic loss can be mitigated.

In addition, preserving an emergency situation fund is necessary to safeguard against unanticipated costs or income disruptions. Professionals advise establishing aside three to six months' well worth of living expenditures in a fluid, conveniently available account. This fund functions as an economic safeguard, providing assurance during stormy times.

On a regular basis evaluating and readjusting economic strategies in feedback to transforming circumstances is additionally critical. Life have a peek at these guys occasions, market fluctuations, and legislative modifications can influence economic stability, underscoring the relevance of ongoing assessment and adaptation in the search of lasting economic protection - trust foundations. By carrying out these techniques attentively and constantly, individuals can strengthen their monetary ground and work in the direction of a much more safe and secure future

Protecting Your Properties Successfully

With a solid foundation in location for financial safety via diversification and emergency fund maintenance, the next important step check over here is safeguarding your properties successfully. One effective approach is possession allowance, which involves spreading your investments across numerous possession classes to decrease risk.

Furthermore, developing a trust can supply a safe means to safeguard your properties for future generations. Trust funds can assist you manage how your properties are distributed, minimize inheritance tax, and secure your wide range from creditors. By carrying out these strategies and looking for specialist advice, you can safeguard your properties successfully and secure your monetary future.

Long-Term Asset Defense

Lasting possession defense involves executing measures to safeguard your assets from various risks such as economic downturns, lawsuits, or unforeseen life occasions. One vital aspect of lasting asset protection is establishing a trust fund, which can use significant advantages in shielding your properties from financial institutions and legal disagreements.

In addition, expanding your investment portfolio is another vital strategy for lasting property protection. By taking a proactive method to long-lasting possession defense, you can secure your wide range and supply monetary security for yourself and future generations.

Final Thought

To conclude, trust fund foundations play a vital role in guarding properties and ensuring economic security. Specialist support in establishing and taking care of trust fund frameworks is vital for lasting asset security. By making use of the knowledge of professionals in this field, people can successfully guard their properties and prepare for the future with confidence. Trust fund structures offer a strong framework for securing wealth and passing it on future generations.